About UBB

Who are we

The Belgian KBC Group is the biggest banking and insurance group in Bulgaria. In Bulgaria it unites companies with years’ long history and versatile experience.

MoreAbout KBC Group

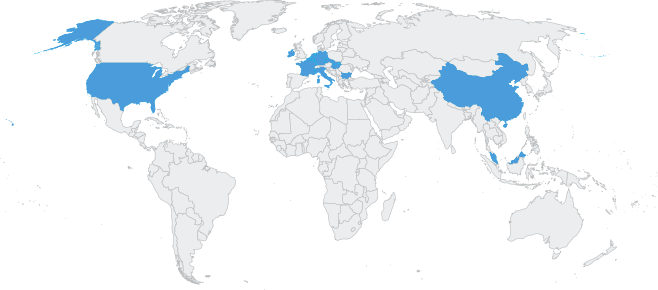

Established in 1998 after the merger of two Belgian banks (Kredietbank and CERA Bank) and one Belgian insurance company (ABB Insurance), today КВС Group is an employer with staff number exceeding 42 000 and a main servicing bank or insurer of over 11 million clients.

More