What do I need to do in order to use UBB’s Mobile Banking?

You could use the general banking information without activation of the application. In order to administer your banking products you should activate the application with your e-banking username and password. In case you are not a client of the Bank’s e-banking service, you can register by visiting any UBB branch or completely online by following the instructions on the following link https://ebb.ubb.bg/ebankreg

On which devices I can use the Mobile banking of UBB?

The Mobile baking works on all devices with mobile operating system Android 7 (or a higher version) or iOS 13 (or a higher version)

Why when trying to activate an error message "Incorrect user or password" appears?

Please, use the same username and password for login as you use in Internet banking. If you are a new user, you have received instructions for activating the service. For assistance, call us at +3592 483 1717.

At login I receive message “Lock password”.

You have been entered more than 5 times wrong password at login in Mobile banking or Internet banking. To unlock, call us at phone: +3592 483 1717 or visit any UBB branch.

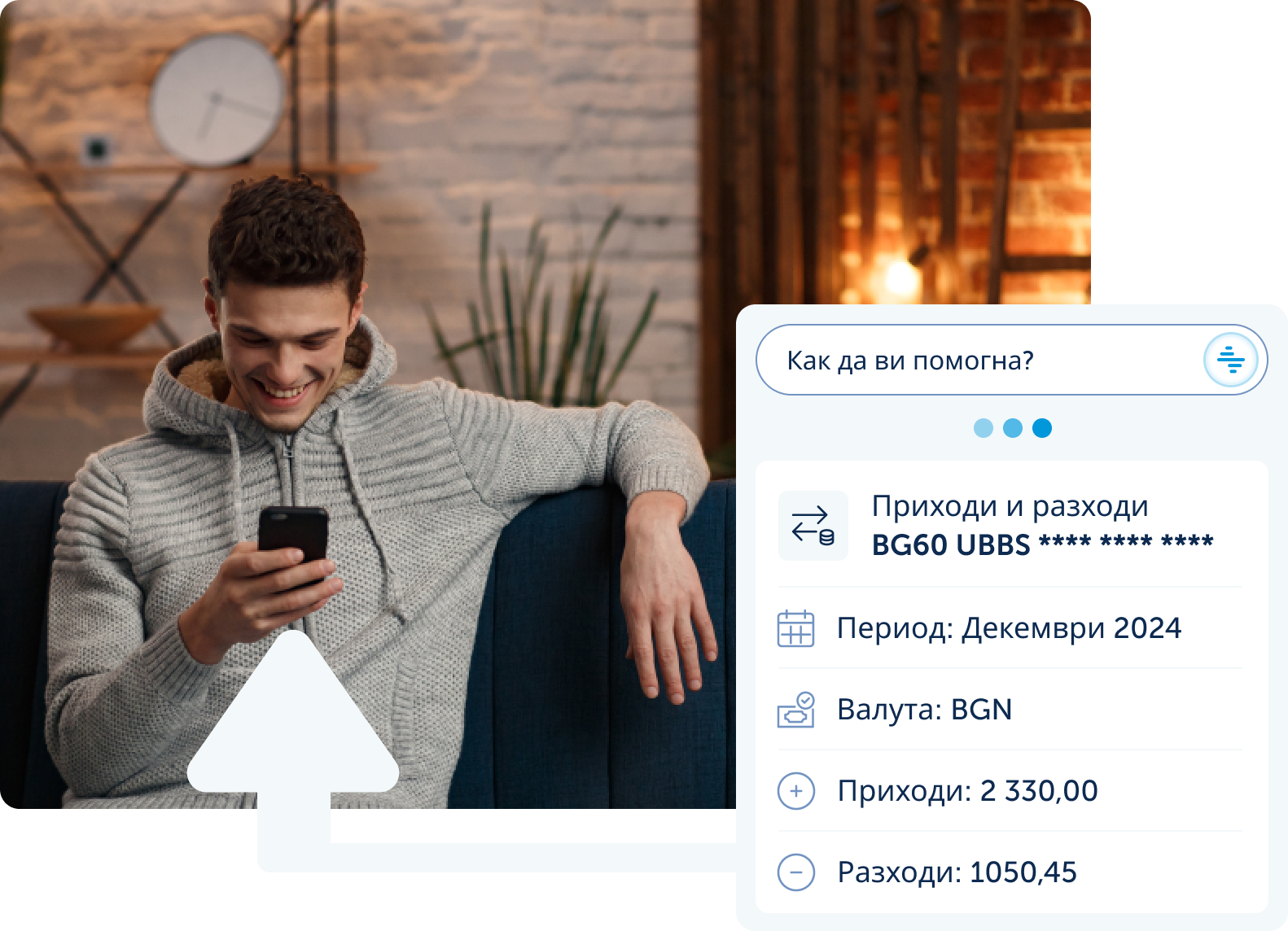

What kind of operations can be made in Mobile banking?

Transaction reports and short statements for accounts, cards, deposits, credits and bill payments. Money transfers between your accounts and cards in UBB, payment of bills, third party and budget transfers.

Can I install the application on more than one device?

Yes, as activation on new device is deactivating application on previous device. Don’t install it on devices, which are out of your control.

Should I use SMS-password or U-code device?

No, they are used only for transfers through an Internet banking.

What should I do in case of lost or stolen mobile device, on which I am using Mobile banking of UBB?

Call at phone +3592 483 1717 or visit convenient branch to block the access.

How can I activate PIN / Fingerprint Login?

PIN code is specifying within activation and can be changed from Info, Settings, Change PIN. About devices with fingerprint sensor, at activation, after specifying a PIN code, you can choose using of fingerprint. From Info, Settings, Identification method you can switch from fingerprint to PIN and vice versa.

Which mobile operating systems allow for PIN / Fingerprint Login functionality?

The PIN Login functionality is available for operating systems, on which the application works - Android 4.4 (or a higher version) and iOS 9 (or a higher version). The Fingerprint Login function is accessible on Android 4.4 (or a higher version) and iOS 9 (or a higher version) devices with a fingerprint sensor, operated in Android through the Google’s official Android Fingerprint API.

Why cannot use fingerprint for login?

Your mobile device does not support any fingerprint functionality, you have not set up such or for Android - fingerprint sensor is not operated through the Google’s official Android Fingerprint API.

Can I use the PIN / Fingerprint Login right after activation?

Yes, chosen identification method is accessible right after starting of Login.

Can I have both PIN and Fingerprint functionality?

No, only one login method may be active. From Info, Settings, Identification method you can switch from PIN to fingerprint and vice versa.

When the application will require another PIN / fingerprint set up for login purposes?

In case you have been activated application on other device.

What are the PIN requirements?

PIN length should be min 6 max 12 digits.

How many wrong PIN attempts does the application allow?

It allows for up to 5 wrong PIN attempts, after that by security reasons application is deactivating automatically and can be activated again.

How can I change my PIN?

If you want to change your PIN code please go to Info, Settings, and Change PIN.

How do I log in, in case I forget my PIN or the fingerprint sensor is not operational?

You can deactivate the application from Settings and to activate it again, thus to specify new PIN. After 5 wrong PIN attempts application is deactivating automatically.

How does the application operate if there is more than one fingerprint, activated on the device?

The application allows for login with all fingerprints, activated on the device.

What happens if I add/remove fingerprint credentials to/from the device?

The application allows for login with all added fingerprints, activated on the device.

What to do in case of a lost or stolen mobile device with activated PIN /Fingerprint Login?

Unauthorized login with your PIN or fingerprint is impossible since these are known and owned only by you. None of your credentials are stored in the application. You can call on +3592 483 1717 or visit convenient branch to block the access.

May I use for login username and password instead of PIN or fingerprint?

No, after activation with username and password application works only with PIN or fingerprint.