What do I need to become a UBB client via my smartphone or tablet?

In order to run the process you need to meet several basic requirements:

- To be a Bulgarian citizen aged over 18.

- To be a holder of a valid ID card

- To have a mobile device with either Android or iOS operating system

- To have access to Internet via your mobile device

- Not to be an existing client of UBB

How much time do I need to become a UBB client via my mobile device?

It usually needs up to 11 minutes to complete the process.

What devices may I use to register as a UBB client?

UBB’s mobile app functions on devices with a mobile operating system Android 5.0 (or higher) or iOS 9 (or higher).

I have installed UBB Mobile in my mobile device, but I cannot activate the application

To activate UBB Mobile you need to be a client of UBB. For the purpose you should run and successfully complete the registration process as a UBB client. In order to run it, from the home screen of the app select the „Become a Client Online“ button.

In case of difficulties you can watch the demo video in our YouTube channel here.

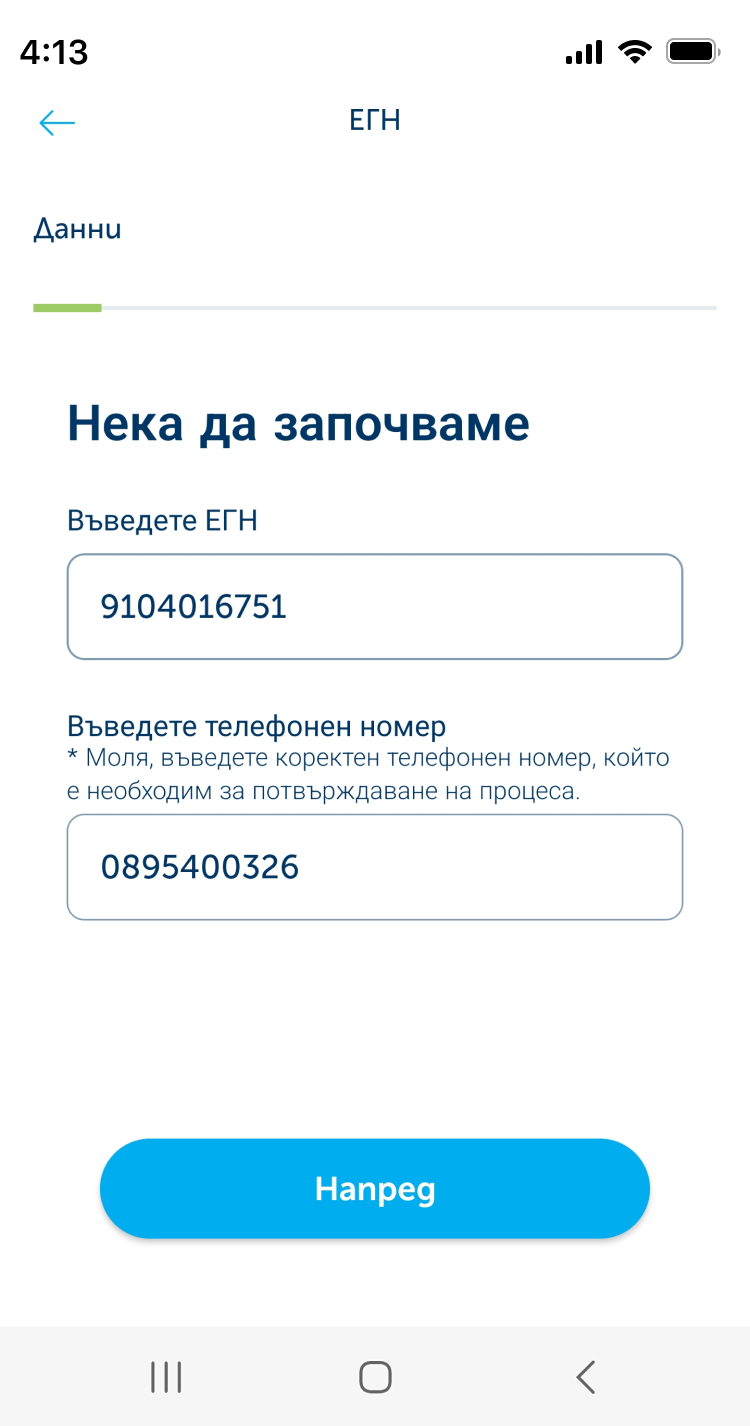

I have entered a Personal ID Number, but the returned status for me is a “wrongly entered Personal ID Number”. What should I do?

Try re-entering your Personal ID Number. Please, bear in mind that this service is accessible by Bulgarian citizens only. If the systems returns again a similar status, you can call us for additional assistance at *7171 or 0700 117 17. You can also visit a convenient for you branch of UBB. A list of all branches is available here.

What is the Evrotrust app and who is its provider?

Evrotrust Technologies is a company, provider of authentication services as per Regulation (ЕU) №910/2014, offering remote qualified electronic authentication, directly from a mobile phone, and which in legal terms is equivalent to appearance in person and issuance of certificates for Qualified Electronic Signatures (QES). QES is being used for signing electronic documents via the mobile phone, and it is legally equivalent to a handwritten signature. All this is enabled via the Evrotrust app, offered by EVROTRUST TECHNOLOGIES AD. More info is available here.

I cannot download the app or complete the authentication process in the Evrotrust app

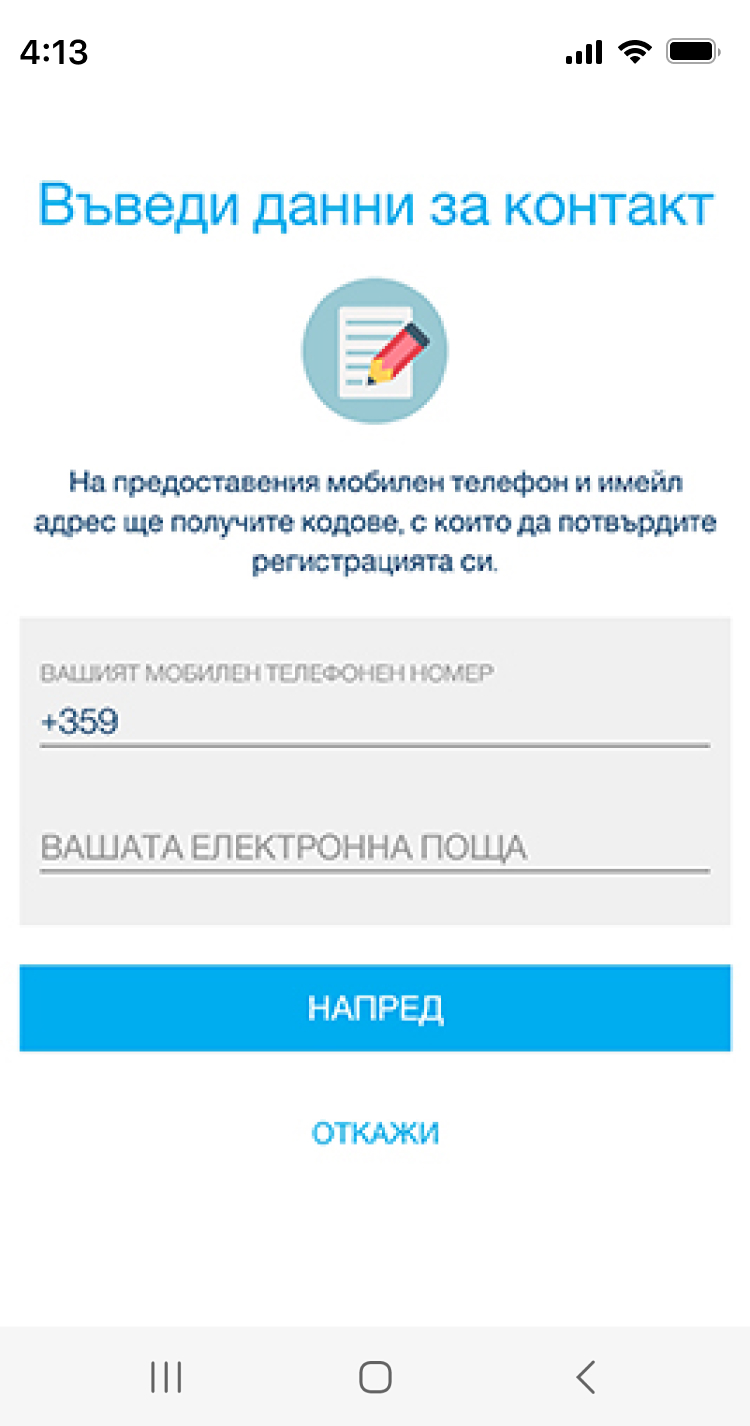

For additional assistance regarding activation or the needed authentication in the Evrotrust app you can contact the team of Evrotrust Technologies at the following telephone number +359882198437 or email address: support@evrotrust.com.For additional assistance regarding activation or the needed authentication in the Evrotrust app you can contact the team of Evrotrust Technologies at the following telephone number +359882198437 or email address: support@evrotrust.com.

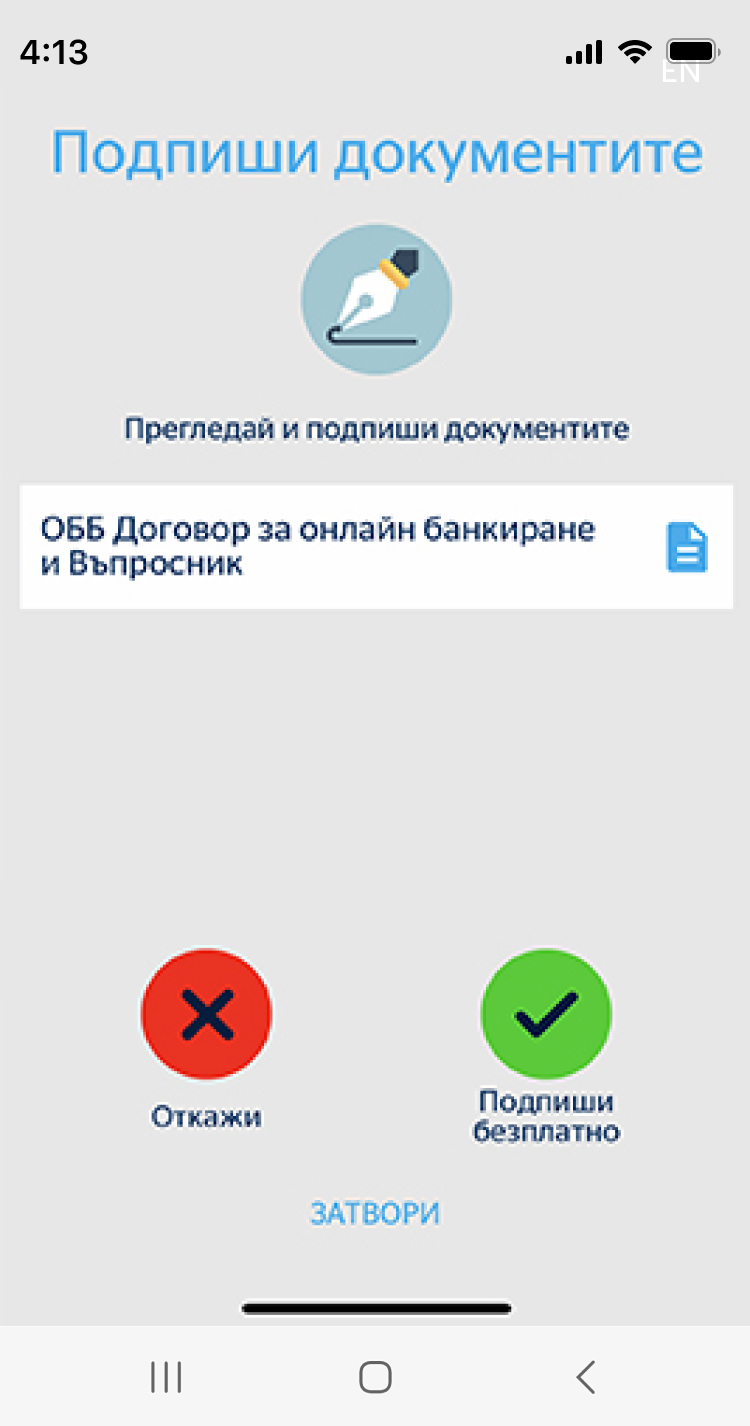

How much would it cost me to use the Evrotrust app and the services it offers?

The app activation is free of charge. The signing through the app of all documents, initiated by UBB, is utterly free of charge for you.

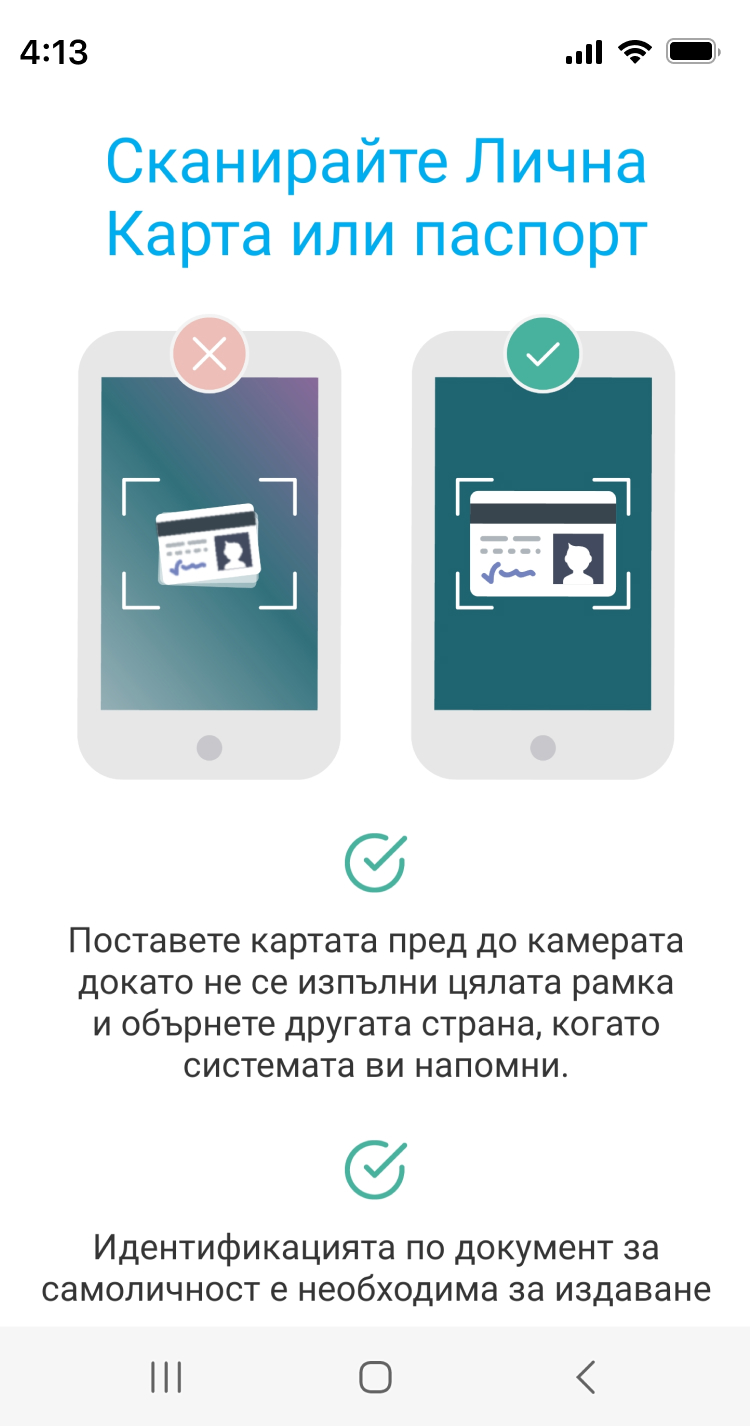

What documents do I need in order to authenticate myself in the Evrotrust app?

You need a valid ID card.

What is a Qualified Electronic Signature?

Electronic signatures are used to sign electronic documents. These are analogous to handwritten signatures, laid on paper. The Qualified е-Signature is the most secure and legally provisioned mechanism for that. More info is available here.

What is an e-Signature Certificate?

Your e-Signature is being issued on the basis of your e-Signature Certificate. More info is available here.